When Sam Bankman-Fried was found guilty this week of defrauding investors at FTX, it caused me to reflect a bit about how to size bets. Sam was famously aggressive with wagers that had any slight edge at all. In one interview he said he’d take a bet where 51% of the time it would double planet Earth and 49% of the time completely destroy it! Not only that, but he’d repeatedly take that wager double-or-nothing because of the diminishing chance at a really great outcome.

What do we know mathematically about sizing bets? If I presented you with the option to wager on a coin flip where a heads will double your money but a tails will cause you to lose half, how much would you risk? The expected value of this wager (50% 2x + 50% x/2 = 1.25x) is greater than 1, so rationally speaking you should bet something. However, betting your entire lifesavings over and over on this wager leads to no return – i.e. repeatedly doubling or halving your money with 50% probability will leave you exactly where you started. For example if you started with $100…

| Wager | Result | Winnings | Total |

| 100 | Win | 100 | 200 |

| 200 | Lose | -100 | 100 |

| 100 | Lose | -50 | 50 |

| 50 | Win | 50 | 100 |

Now consider a strategy where you repeatedly bet 50% of your total on the wager:

| Wager | Result | Winnings | Total |

| 50 | Win | 50 | 150 |

| 75 | Lose | -37.5 | 112.5 |

| 56.25 | Lose | -28.13 | 84.37 |

| 42.19 | Win | 42.19 | 126.56 |

By better sizing the bets we’ve actually come up with a strategy that makes money! This wager is known as Shannon’s Demon and was originally proposed by Claude Shannon, one of the greatest electrical engineers of all time (the guy invented bits!), and who also happened to be a hell of an investor as well.

What’s going on here is that by only investing 50% of your bankroll on each wager, you’re effectively selling high in a systematic way, banking half of your winnings after a win yet still being aggressive after a loss to take advantage of the positive expected value of each individual wager. You can also think about it as a way to preserve your bankroll to allow the law of large numbers to kick in and increase the odds you will succeed over time. (If you want to do more Googling on the topic, this strategy is also known as reducing volatility drag or constructing a positive gamma portfolio, but I digress.)

It turns out there’s a really nice mathematical formula for determining how much you should wager on a game like this to maximize long term wealth growth: the Kelly Criterion. This formula was developed by John Kelly in 1956, who worked closely with Shannon at Bell Labs.

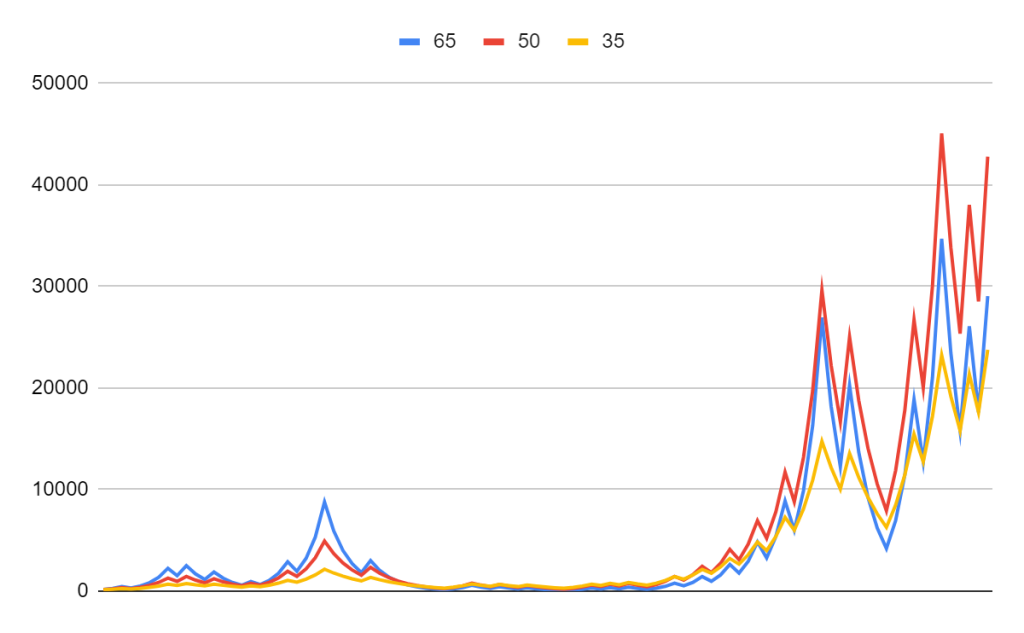

The Kelly formula is f = R/L – (1 – R)/W, where f is the fraction of your money you should wager, R is the chance that you win, L is the fraction of the bet you would lose, and W is the fraction of the bet you would win. In the coin flip example above f = 0.5/0.5 – (1 – 0.5)/1 = 0.5, or 50% of your money. I simulated the coin game using three different ratios 65%, 50%, and 35%; and we can see in the chart below that 50% does indeed outperform the other two strategies in the long run by quite a bit.

When the Kelly paper was first published it became popular with horse racing and blackjack gamblers. There are many applications in investing and resource allocation problems as well (e.g., how many people should I devote to a speculative project at work), just to name a few. This formula has a number of simplifications that need to be considered before applying it in an investment setting though – transaction costs, taxes, the impossibility of knowing the probability and magnitude of wins/losses a priori – and I’d recommend the more thorough academic treatment of the topic found in this book if you’re interested (though be warned the “theory and practice” mentioned in the title is pretty light on “practice”).

It’s also worth noting that strictly applying the Kelly formula often leads to very large bets that most people are uncomfortable with. In practice most people apply a multiplier (aka “fractional Kelly”) to reduce the exposure to wild swings in valuation you can see in the chart above. I don’t imagine the average person could stomach having their net worth go from $30,000 to under $10,000 as the 50% strategy does before later recovering.

Now back to Sam Bankman-Fried: In few semi-famous Twitter threads Sam lambastes Kelly as “way too conservative for many people“! He has some other quibbles about the log utility of money and makes some valid points about finding real-world bets that are as repeatable as the example, but at the end of the day I can’t help but wonder if FTX would still be around if he had sized his (illegal) bets more appropriately to preserve the bankroll.

Leave a comment